Stock trading demands understanding stock charts; this guide, like a free eBook, equips beginners with essential knowledge for confident market navigation and portfolio growth.

Learning to interpret these visual tools—available as a PDF—unlocks insights into price movements, volume, and potential future performance, crucial for informed investment decisions.

What are Stock Charts?

Stock charts are visual representations of a security’s price history over a specific period. They transform raw price data into easily digestible formats, revealing patterns and trends that would be difficult to discern from a simple list of numbers. Think of them as a roadmap of a stock’s journey, offering clues about its past performance and potential future direction.

These charts aren’t just pretty pictures; they are powerful analytical tools. A beginner’s PDF guide will demonstrate how different chart types – line, bar, and candlestick – display this information. They illustrate price fluctuations, trading volume, and key market events. Understanding these visual cues is fundamental to technical analysis, a method of evaluating securities by analyzing statistical patterns generated by market activity.

Essentially, stock charts translate complex market data into a language that investors can understand, aiding in informed decision-making.

Why Learn to Read Stock Charts?

Learning to read stock charts empowers investors with the ability to make more informed trading decisions. A beginner’s PDF guide unlocks the potential to identify trends, recognize potential entry and exit points, and manage risk effectively. It moves you beyond simply reacting to market news and allows for proactive strategy development.

Understanding chart patterns and indicators, as detailed in introductory resources, can reveal opportunities others might miss. This skill isn’t about predicting the future, but about assessing probabilities and making calculated risks. It’s about understanding market psychology and how collective investor behavior impacts price movements.

Ultimately, mastering stock chart analysis increases your confidence and control in the market, leading to potentially more profitable and sustainable investment outcomes.

Basic Stock Chart Components

Stock charts visually represent price and volume; a beginner’s PDF will explain the X and Y axes, and how these elements combine to reveal market data.

X-Axis: Timeframes

The x-axis of a stock chart represents the timeframe, displaying the passage of time from left to right. A beginner’s PDF will detail how these timeframes are crucial for analysis. Common timeframes include minutes, hours, days, weeks, and months – each offering a different perspective on price action.

Shorter timeframes, like minutes or hours, are favored by day traders seeking quick profits, while longer timeframes, such as weeks or months, are preferred by investors with a longer-term outlook. Understanding which timeframe you’re viewing is essential for interpreting the chart correctly. A PDF guide will emphasize that choosing the right timeframe depends on your trading style and investment goals. Different timeframes reveal different chart patterns and trends, impacting trading strategies.

Y-Axis: Price

The y-axis of a stock chart displays the price of the stock, typically ranging from the lowest to the highest price achieved during the selected timeframe. A beginner’s PDF will explain that price is the fundamental element visualized on any stock chart. Price movements – increases and decreases – are the core of technical analysis.

Understanding the price scale is vital; a PDF guide will highlight how to accurately read price levels and identify potential support and resistance areas. The y-axis allows traders to quickly assess the magnitude of price changes and compare performance across different stocks. Analyzing price fluctuations in relation to the timeframe (x-axis) provides valuable insights into market sentiment and potential trading opportunities.

Volume

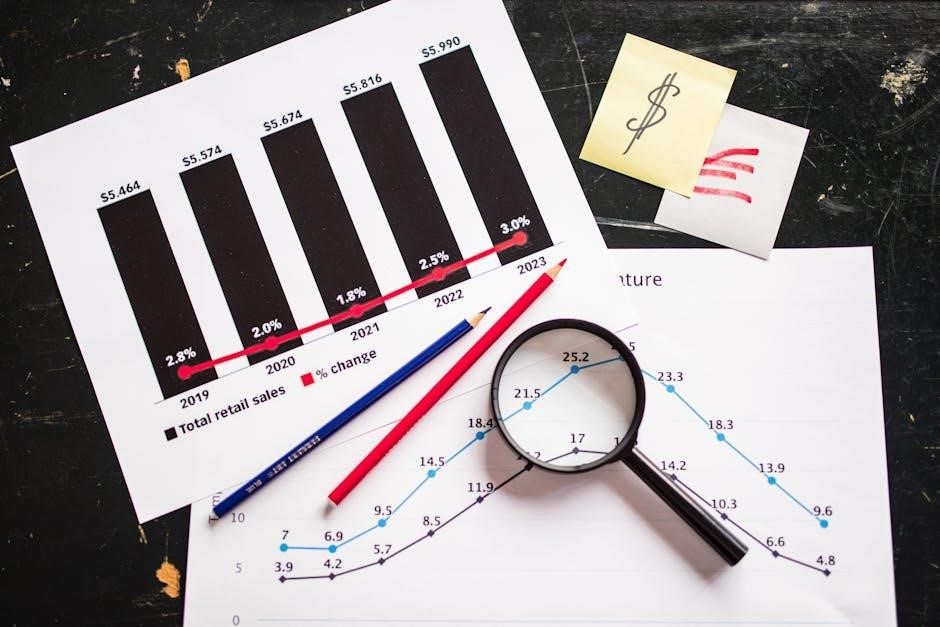

Stock chart volume, often displayed at the bottom of the chart, represents the number of shares traded during a specific period. A beginner’s PDF will emphasize that volume confirms price trends; rising prices with increasing volume suggest a strong uptrend, while falling prices with increasing volume indicate a strong downtrend.

Low volume can signal a weak trend or potential reversal. Learning to interpret volume, as detailed in a comprehensive PDF guide, is crucial for validating chart patterns and identifying potential trading opportunities. Volume divergence – when price and volume move in opposite directions – can be a warning sign of a trend change. Understanding volume helps assess the strength and reliability of price movements.

Types of Stock Charts

A beginner’s PDF reveals various chart types—line, bar, candlestick, and point & figure—each visualizing price data uniquely, aiding analysis and informed trading decisions.

Line Charts

Line charts represent a stock’s price movement over a specific period, connecting closing prices with a continuous line. This simplicity makes them ideal for beginners learning to read stock charts, as found in introductory PDFs.

They effectively illustrate trends – whether prices are generally rising (uptrend), falling (downtrend), or moving sideways (sideways trend). However, line charts omit crucial data like intraday price fluctuations and volume, offering a limited view of market activity.

A PDF guide will show you that while easy to interpret, relying solely on line charts can lead to incomplete analysis. They are best used as a starting point, supplemented by other chart types and indicators for a more comprehensive understanding of a stock’s performance.

Bar Charts

Bar charts, often detailed in stock charts for beginners PDFs, provide a more detailed view than line charts. Each bar represents the price range for a specific period – the opening price, closing price, highest price, and lowest price.

The vertical line indicates the full price range, with small dashes showing the open and close. A PDF guide will explain that if the closing price is above the opening price, the bar is typically white or green, indicating a price increase.

Conversely, a black or red bar signifies a price decrease. While more informative than line charts, bar charts can still appear cluttered, especially when analyzing shorter timeframes. They are a valuable step up in complexity for new traders.

Candlestick Charts

Candlestick charts, frequently covered in stock charts for beginners PDFs, are a popular choice among traders due to their visual clarity. Similar to bar charts, they display open, high, low, and close prices, but in a more intuitive format.

The “body” of the candlestick represents the range between the open and close. A filled (often red or black) body indicates the closing price was lower than the opening price, signaling a bearish trend. A hollow (green or white) body shows the opposite – a bullish trend.

“Wicks” or “shadows” extend above and below the body, representing the highest and lowest prices. Learning to interpret these patterns is key, and a good PDF guide will detail common candlestick formations.

Point and Figure Charts

Point and Figure charts, often found within comprehensive stock charts for beginners PDFs, differ significantly from traditional time-based charts. They filter out minor price fluctuations, focusing solely on significant price movements. Instead of a time-based X-axis, these charts use boxes arranged in a grid.

An “X” is placed in a box when the price rises by a predetermined amount (the “box size”), and an “O” is placed when it falls by the same amount. These charts help identify key support and resistance levels, and potential reversal points, by visually highlighting price breakouts.

They are particularly useful for identifying long-term trends, as they eliminate “noise” and provide a clearer picture of price direction. A detailed PDF guide will explain box sizing and signal interpretation.

Key Chart Patterns

Stock charts for beginners PDFs reveal patterns like Head and Shoulders, Double Tops/Bottoms, and Triangles, signaling potential trend reversals or continuations.

Recognizing these formations is vital for predicting price movements and making informed trading decisions.

Head and Shoulders

Stock charts for beginners, often detailed in a PDF guide, frequently highlight the “Head and Shoulders” pattern as a significant bearish reversal signal.

This pattern visually resembles a head with two shoulders, formed by three successive peaks. The middle peak (the head) is higher than the two surrounding peaks (the shoulders). Connecting the peaks creates a “neckline.”

A confirmed break below the neckline, accompanied by increased volume, suggests a potential downtrend. Traders often interpret this as a signal to sell. Conversely, an “Inverse Head and Shoulders” pattern signals a potential bullish reversal. Understanding volume confirmation is crucial; a breakout without volume is often unreliable.

Beginners should practice identifying this pattern on historical charts to improve recognition skills.

Double Top/Bottom

A stock charts for beginners PDF will invariably cover “Double Top” and “Double Bottom” patterns, key reversal indicators. A Double Top forms after an asset reaches a high, retreats, then attempts to reach the same high again, failing to do so.

This creates two peaks at roughly the same level, signaling potential resistance and a possible downtrend. Conversely, a Double Bottom appears after an asset hits a low, rises, then attempts to reach that low again, failing.

This forms two troughs, indicating potential support and a possible uptrend; Confirmation requires a break below the connecting trough line (Double Top) or above (Double Bottom) with increased volume.

These patterns, when correctly identified, offer valuable trading opportunities for those learning to read stock charts.

Triangles (Ascending, Descending, Symmetrical)

A comprehensive stock charts for beginners PDF will detail triangle patterns – powerful indicators of consolidation and potential breakouts. Ascending triangles form with a flat resistance line and an upward-sloping support line, suggesting a bullish breakout.

Descending triangles exhibit a flat support line and a downward-sloping resistance line, hinting at a bearish breakdown. Symmetrical triangles, characterized by converging trendlines, indicate indecision.

Breakouts from these triangles, ideally accompanied by increased volume, signal the likely direction of the next significant price move.

Understanding these formations is crucial for identifying potential trading opportunities and managing risk, as outlined in many introductory guides.

Stock Chart Indicators

Stock charts for beginners PDFs explain indicators like Moving Averages, RSI, and MACD, offering deeper insights beyond price action for informed trading decisions.

Moving Averages

Moving Averages are fundamental tools discussed in stock charts for beginners PDFs, smoothing price data to identify trends. They calculate the average price over a specific period, reducing noise and highlighting the direction of the stock.

Simple Moving Averages (SMAs) equally weight all prices within the period, while Exponential Moving Averages (EMAs) give more weight to recent prices, making them more responsive.

Traders use moving averages to identify potential support and resistance levels, as well as to generate buy and sell signals when the price crosses above or below the average. A common strategy involves using two moving averages – a shorter-term and a longer-term – to identify crossover points, signaling potential trend changes. Understanding these concepts is key to successful chart analysis.

Relative Strength Index (RSI)

The Relative Strength Index (RSI), a key indicator in stock charts for beginners PDFs, measures the magnitude of recent price changes to evaluate overbought or oversold conditions. It oscillates between 0 and 100.

Generally, an RSI above 70 suggests a stock may be overbought, potentially signaling a price correction. Conversely, an RSI below 30 indicates an oversold condition, hinting at a possible price rebound.

However, RSI shouldn’t be used in isolation. Divergences – where the price makes new highs but the RSI doesn’t – can signal weakening momentum. Learning to interpret RSI alongside other indicators and chart patterns is crucial for effective trading strategies, as detailed in introductory guides.

MACD (Moving Average Convergence Divergence)

MACD, or Moving Average Convergence Divergence, is a trend-following momentum indicator frequently found in stock charts for beginners’ PDFs. It displays the relationship between two moving averages of a security’s price.

The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A nine-period EMA of the MACD itself is then plotted as the “signal line.”

Traders watch for MACD crossovers: when the MACD line crosses above the signal line, it’s a bullish signal; below, it’s bearish. Divergences between price and MACD can also signal potential trend reversals, offering valuable insights for informed trading decisions, as explained in beginner resources.

Understanding Support and Resistance Levels

Stock charts, like those in a beginner’s PDF, reveal key price levels where buying (support) or selling (resistance) pressure concentrates, influencing future movements.

Identifying Support Levels

Support levels, visually apparent on stock charts – often detailed in a beginner’s PDF – represent price points where a stock tends to find buying interest, halting or reversing a downtrend. These levels form as a result of increased buying pressure, indicating that more investors are willing to purchase the stock at that price than sell it.

To identify support, look for areas on the chart where the price has previously bounced or reversed upwards. Common techniques include identifying swing lows, previous resistance levels that have been broken, and areas of high volume. A strong support level is often confirmed when it is tested multiple times without being broken, demonstrating consistent buying interest at that price point. Recognizing these levels is crucial for potential entry points when considering a long position.

Identifying Resistance Levels

Resistance levels, clearly illustrated in stock charts and often explained in introductory PDFs, signify price points where a stock encounters selling pressure, potentially stopping an uptrend. These levels emerge as more investors choose to sell than buy, creating a ceiling on price movement.

Locate resistance by observing areas on the chart where the price has previously stalled or reversed downwards. Key indicators include swing highs, prior support levels that have been breached, and zones of substantial trading volume. A robust resistance level gains confirmation through repeated testing without a successful breakout, showcasing consistent selling interest. Identifying these levels is vital for evaluating potential exit points or considering short positions.

Trading with Volume

Volume analysis, detailed in stock chart PDFs, confirms price trends; increasing volume during a breakout signals strength, while divergence warns of potential reversals.

Volume Confirmation

Volume confirmation is a crucial aspect of stock chart analysis, particularly when identifying potential breakouts or breakdowns, as detailed in many beginner’s PDF guides. Essentially, it means observing whether trading volume supports the price action. A genuine breakout, for instance, should be accompanied by a significant increase in volume.

This surge indicates strong conviction among traders and suggests the price move is likely sustainable. Conversely, a breakout with low volume may be a false signal, indicating a lack of genuine interest and a higher probability of the price reversing. Similarly, a breakdown below a support level should ideally be accompanied by high volume, confirming the bearish sentiment.

Stock chart PDFs often emphasize that volume acts as a ‘footprint’ of the market, providing valuable insight into the strength and validity of price movements. Always consider volume alongside price action for a more reliable trading strategy.

Volume Divergence

Volume divergence, a key concept covered in stock chart reading PDFs for beginners, occurs when price action and trading volume move in opposite directions. This discrepancy can signal a potential trend reversal. For example, if a stock price is making new highs, but volume is declining, it suggests weakening momentum.

This bearish divergence indicates that fewer traders are participating in the upward move, potentially foreshadowing a price correction. Conversely, if the price is hitting new lows while volume is increasing, it suggests buying pressure is building, hinting at a possible bullish reversal.

Understanding these divergences, as highlighted in many stock chart guides, allows traders to anticipate shifts in market sentiment and make more informed decisions. It’s a powerful tool for identifying potential trading opportunities.

Resources for Further Learning

Expand your knowledge with free eBooks, online courses, and stock charting software—essential tools for mastering stock chart analysis, as found in beginner PDFs.

Free eBooks and Guides

Embark on your learning journey with readily available, complimentary resources! Several free eBooks and guides cater specifically to those new to stock chart analysis. The “Stock Trading for Beginners” eBook, boasting over 6 million downloads, provides a comprehensive foundation for understanding the stock market and building a robust portfolio.

Furthermore, explore free trading courses designed to equip you with the necessary skills to confidently navigate financial markets. These resources, often led by experienced instructors like Tommy, offer practical advice and insights. Look for downloadable PDFs focusing on stock charts, covering everything from basic components to advanced pattern recognition. Mixkit also provides free stock video clips and templates.

These guides are invaluable for grasping concepts like price movements, volume analysis, and identifying potential trading opportunities, all presented in an accessible format for beginners.

Online Courses

Elevate your understanding with structured online courses designed for all levels! Many platforms offer comprehensive training on reading stock charts, ranging from introductory modules to advanced technical analysis. These courses often feature video lectures, interactive exercises, and real-world case studies, providing a dynamic learning experience.

Look for courses specifically tailored for beginners, focusing on fundamental concepts like chart types (line, bar, candlestick), key patterns (head and shoulders, triangles), and essential indicators (moving averages, RSI, MACD). Some courses offer downloadable PDFs as supplementary materials, reinforcing key learnings.

These structured programs, often led by industry experts, provide a more in-depth exploration than free guides, enabling you to develop a strong foundation for informed trading decisions and portfolio management.

Stock Charting Software

Unlock the power of visual analysis with dedicated stock charting software! These tools automate data collection and calculations, simplifying the process of interpreting stock price movements and identifying potential trading opportunities. Many platforms offer free trials or basic versions suitable for beginners.

Essential features include various chart types (candlestick, line, bar), customizable indicators (RSI, MACD, moving averages), and drawing tools for identifying support and resistance levels. Some software integrates with brokerage accounts for seamless trading.

Downloading a PDF guide on how to use the software alongside its built-in tutorials can accelerate your learning curve. Explore options like TradingView, MetaTrader, or Thinkorswim to find a platform that suits your needs and investment style.